Simple

Easy to understand single, multi or nested triggers against various weather perils.

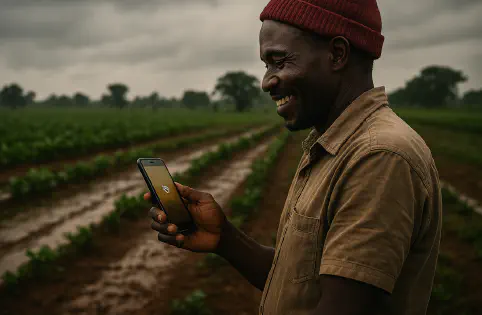

Riskwolf is the platform to design, launch and monitor parametric insurance programs for climate and weather risks

We can help you customize parametric programs that focus on specific customer needs

Easy to understand single, multi or nested triggers against various weather perils.

Layered weather data from local & global sources to maximize predictive, preventive and protective risk view.

Parametric payouts that allow for a quick recovery of the insured by initiating notifications within hours of trigger breach.

Flexible and automated pricing models with customizable options.

API driven integration with distribution & Insurers

Real-time risk monitoring and Payout alerts with advanced analytics

How farmer lending can be bundled with extreme weather coverage to protect repayments, support recovery, and build long-term climate resilience.

Discover how Riskwolf supported AgGuard to structure and build of parametric insurance in New Zealand and Australia.

HDFC Ergo and FIL Industries renew appleINSURE, an innovative parametric insurance product designed specifically for apple growers in Jammu & Kashmir and Himachal …