Crop Cycles

Customize against unique weather challenges at every stage. Build single, multi or nested triggers that protect from seed to harvest.

Protecting against it doesn’t need to be.

cropINSURE protects crops with a specific weather index that pays out as and when a calamity strikes.

Customize against unique weather challenges at every stage. Build single, multi or nested triggers that protect from seed to harvest.

Weather impact doesn’t stop at harvest. Why should your insurance protection? Supply chain disruptions can derail food security measures.

Global market interdependence can destroy forecasts even if all precautions at a local level are taken.

“Innovation that is tailored to the geography and specific needs within the crop cycle - with a payout that are tied to a weather event, during the cycles, rather than a loss assessment in the end”- HDFC Ergo.

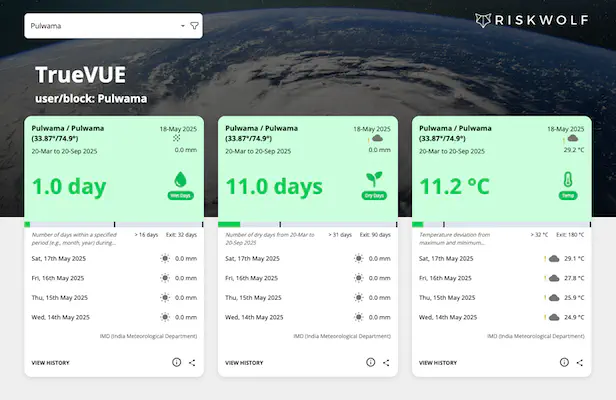

“Live view of the appleINSURE program with specific reports gives us real-time status of the triggers on a per location basis for our customers” - SafeTree

How farmer lending can be bundled with extreme weather coverage to protect repayments, support recovery, and build long-term climate resilience.

Discover how Riskwolf supported AgGuard to structure and build of parametric insurance in New Zealand and Australia.

HDFC Ergo and FIL Industries renew appleINSURE, an innovative parametric insurance product designed specifically for apple growers in Jammu & Kashmir and Himachal …