Farm Loans

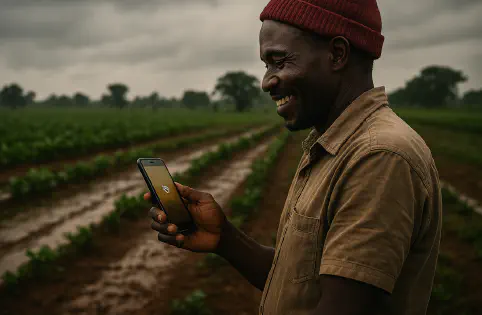

Short term loans are a lifeline for farmers but weather disruptions can wipe out harvests. A built in loanINSURE program can help them continue without the burden of repayment.

loanINSURE is a program that protects loan portfolios and helps your customers plan for loan/interest payback continuity.

Short term loans are a lifeline for farmers but weather disruptions can wipe out harvests. A built in loanINSURE program can help them continue without the burden of repayment.

Manufacturing requires long term loans that help with monthly rolling expenses but any weather impact can slow down the output and put pressure on timely interest payments.

SMEs are the growth engines of the economy and depend on loans to run their business. Weather disruptions can push these accounts into the NPL category

How farmer lending can be bundled with extreme weather coverage to protect repayments, support recovery, and build long-term climate resilience.

Discover how Riskwolf supported AgGuard to structure and build of parametric insurance in New Zealand and Australia.

HDFC Ergo and FIL Industries renew appleINSURE, an innovative parametric insurance product designed specifically for apple growers in Jammu & Kashmir and Himachal …